Net Worth Calculator

Assets

Liabilities

What Is a Net Worth Calculator and How to Use It

In today’s financial world, understanding your personal wealth is just as important as budgeting or saving. One of the most effective tools to gain insight into your financial standing is a Net Worth Calculator. Whether you’re a young professional, a growing family, or planning for retirement, tracking your net worth helps you see the full picture of your finances.

This article breaks down what a net worth calculator is, why it’s important, how to use one, and the benefits of tracking your net worth over time.

What Is Net Worth?

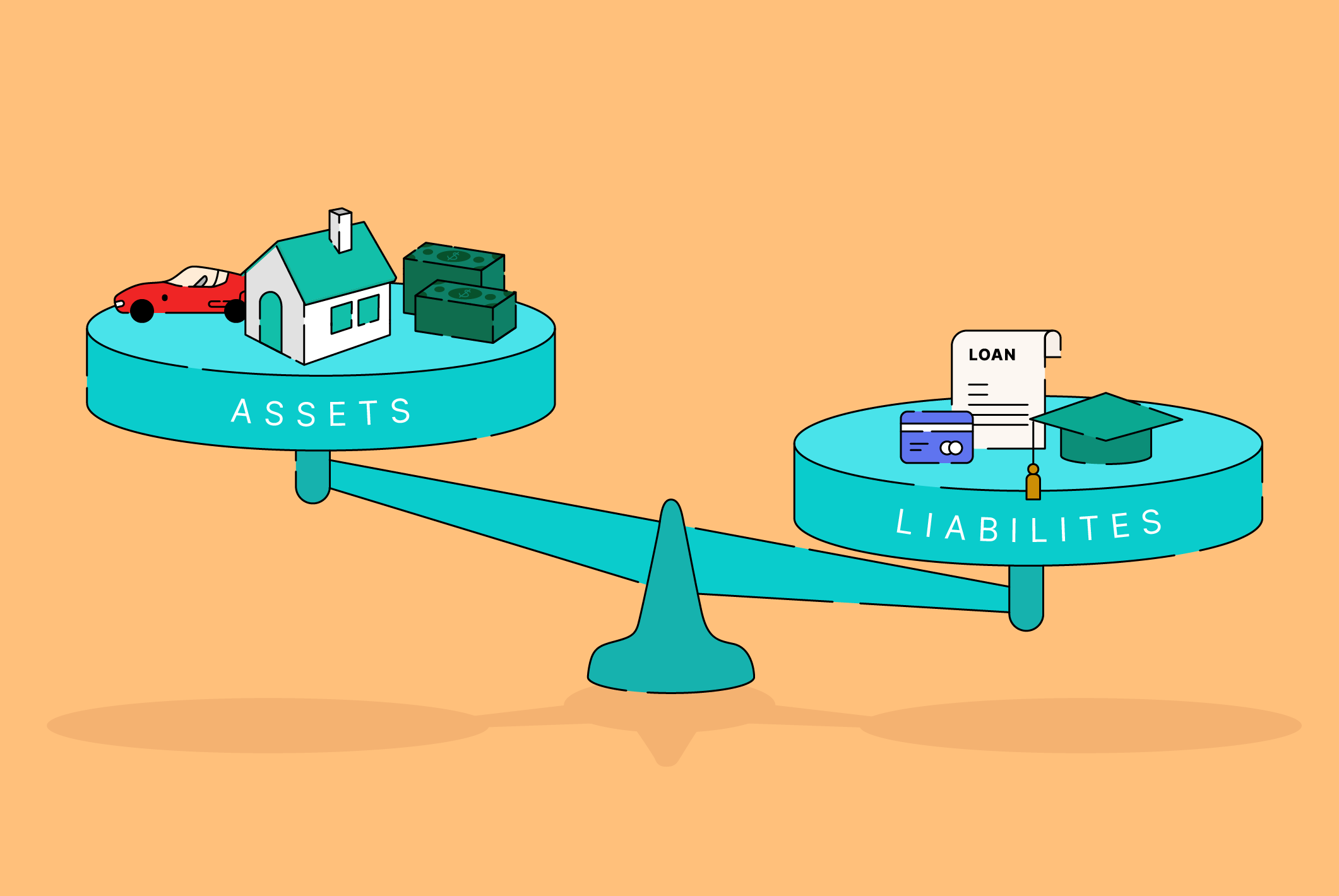

Net worth is a financial metric that represents the difference between what you own (assets) and what you owe (liabilities). It’s essentially a snapshot of your current financial health.

Net Worth Formula:

Net Worth = Total Assets – Total Liabilities

If your assets exceed your liabilities, you have a positive net worth. If your debts outweigh what you own, your net worth is negative. Monitoring this figure helps you assess your financial progress and make better money decisions.

What Is a Net Worth Calculator?

A Net Worth Calculator is a digital tool—often available on finance websites or personal finance apps—that helps you calculate your net worth in minutes. By inputting values for your assets and liabilities, the calculator provides a real-time overview of your financial situation.

Why Use a Net Worth Calculator?

Here are some top reasons people use a net worth calculator:

1. Financial Clarity

Know exactly where you stand financially, not just how much you earn.

2. Goal Tracking

Are you saving for a home? Planning to retire early? Use your net worth to measure progress.

3. Debt Awareness

See how much debt you carry versus your total assets.

4. Wealth Growth

Track how your financial profile grows over time—from paying off loans to building investments.

5. Simple Budget Planning

Your net worth helps shape how much you can afford to spend, save, or invest.

How to Use a Net Worth Calculator: Step-by-Step Guide

Using a net worth calculator is easier than you might think. Follow these steps to calculate your net worth quickly and accurately:

Step 1: List Your Assets

Start by identifying everything you own that has financial value. Common asset categories include:

- Cash and Bank Accounts

Checking, savings, and emergency funds. - Investments

Stocks, bonds, mutual funds, retirement accounts (401k, IRA), and crypto. - Real Estate

Your home, rental property, or land. - Vehicles

Cars, motorcycles, boats (current market value). - Other Valuables

Jewelry, art, collectibles, and business ownership stakes.

✅ Tip: Use market values, not purchase prices, for the most accurate results.

Step 2: List Your Liabilities

Now account for what you owe. Common liabilities include:

- Mortgage Balance

What’s left on your home loan. - Credit Card Debt

Outstanding balances on all credit cards. - Student Loans

Federal or private student loan balances. - Auto Loans

Remaining amount on vehicle financing. - Personal Loans

Any other borrowed money with interest. - Medical Bills & Taxes Owed

✅ Tip: Double-check statements or apps for up-to-date balances.

Step 3: Input Values into the Calculator

Use the net worth calculator with separate sections for assets and liabilities. Input each amount into its respective category.

The calculator will automatically total both sides and subtract liabilities from assets to give you your net worth result.

Step 4: Review the Results

You’ll see your:

- Total assets

- Total liabilities

- Net Worth

Step 5: Track Over Time (Optional)

For more value, record your net worth monthly or quarterly. Watching your progress (or setbacks) helps reinforce smart financial habits.

Example: Simple Net Worth Calculation

Let’s say you own the following:

- $10,000 in savings

- $15,000 in investments

- $200,000 home (with $150,000 mortgage)

- $8,000 car (with $4,000 auto loan)

Your Assets:

- Savings: $10,000

- Investments: $15,000

- Home: $200,000

- Car: $8,000

Total Assets = $233,000

Your Liabilities:

- Mortgage: $150,000

- Auto Loan: $4,000

Total Liabilities = $154,000

Net Worth = $233,000 – $154,000 = $79,000

So, your net worth is $79,000.

Why Tracking Net Worth Matters

A single net worth snapshot is useful—but tracking it regularly is even more powerful.

Here’s why:

You Can Measure Progress

Compare your net worth every month or year to monitor growth, financial setbacks, or stagnation.

Spot Trends

Are you saving more? Is debt creeping up? A net worth trendline will tell you.

Stay Motivated

Seeing your numbers move in the right direction can reinforce good habits—saving, investing, paying down debt.

Pro Tips for Using a Net Worth Calculator

- Be conservative with valuations (especially for cars or collectibles).

- Update your numbers monthly to stay accurate.

- Exclude depreciating assets like furniture unless highly valuable.

- Include hidden liabilities like tax debts or missed payments.

- Don’t panic if your net worth is negative—it’s common, especially with student loans.

Final Thoughts

A Net Worth Calculator is more than just a number cruncher—it’s your personal financial dashboard. Whether you’re saving for a goal, trying to get out of debt, or simply organising your money, this tool helps you understand your true financial position in seconds.

By consistently calculating and tracking your net worth, you gain confidence, clarity, and control over your financial future.

So, the next time you’re asking, “How am I really doing financially?”—don’t guess. Use a Net Worth Calculator and find out.

Leave a Reply